Block Builder Deep Dive: Ethereum BuilderNet (I)

Table of Contents

Background

Today, roughly 80% of Ethereum blocks are built by two builders: Titan and BuilderNet. That concentration creates three immediate issues:

- Censorship risk: a single builder policy can directly decide whether a transaction gets included

- Orderflow monopoly: major wallets and aggregators often sign exclusive deals, leaving smaller participants with weaker access

- Opaque MEV distribution: value created by users is often captured by builders and a small set of partners

Two important milestones for BuilderNet:

- 2024-11-26: Flashbots launched BuilderNet with Beaverbuild and Nethermind

- 2025-05-06: Beaverbuild retired its centralized builder and fully migrated to BuilderNet

| Builder | Blocks | Market Share | Avg Tx/Block | Median Block Value |

|---|---|---|---|---|

| Titan Builder | 98,464 | 49.53% | 231 | 0.0085 |

| BuilderNet | 56,449 | 28.39% | 242 | 0.0086 |

| Quasar (quasar.win) | 34,335 | 17.27% | 216 | 0.0071 |

| Builder+ (www.btcs.com/builder) | 3,212 | 1.62% | 181 | 0.0282 |

| Beaverbuild | 1,835 | 0.92% | 247 | 0.0130 |

| Eureka (eurekabuilder.xyz) | 1,511 | 0.76% | 126 | 0.0053 |

| shimmerblocks.com | 1,455 | 0.73% | 100 | 0.0066 |

| bobTheBuilder.xyz | 904 | 0.45% | 54 | 0.0130 |

Core Idea

BuilderNet's goal is simple: multiple operators run the same open-source builder, share orderflow, and reduce single-operator dominance.

The design rests on three pillars:

- TEE: based on Intel TDX, so operators cannot inspect plaintext orderflow or arbitrarily modify execution logic

- Shared orderflow: transactions and bundles are broadcast over P2P instead of being kept as exclusive inventory

- Public refund rules: MEV refunds are distributed by marginal contribution

System Architecture

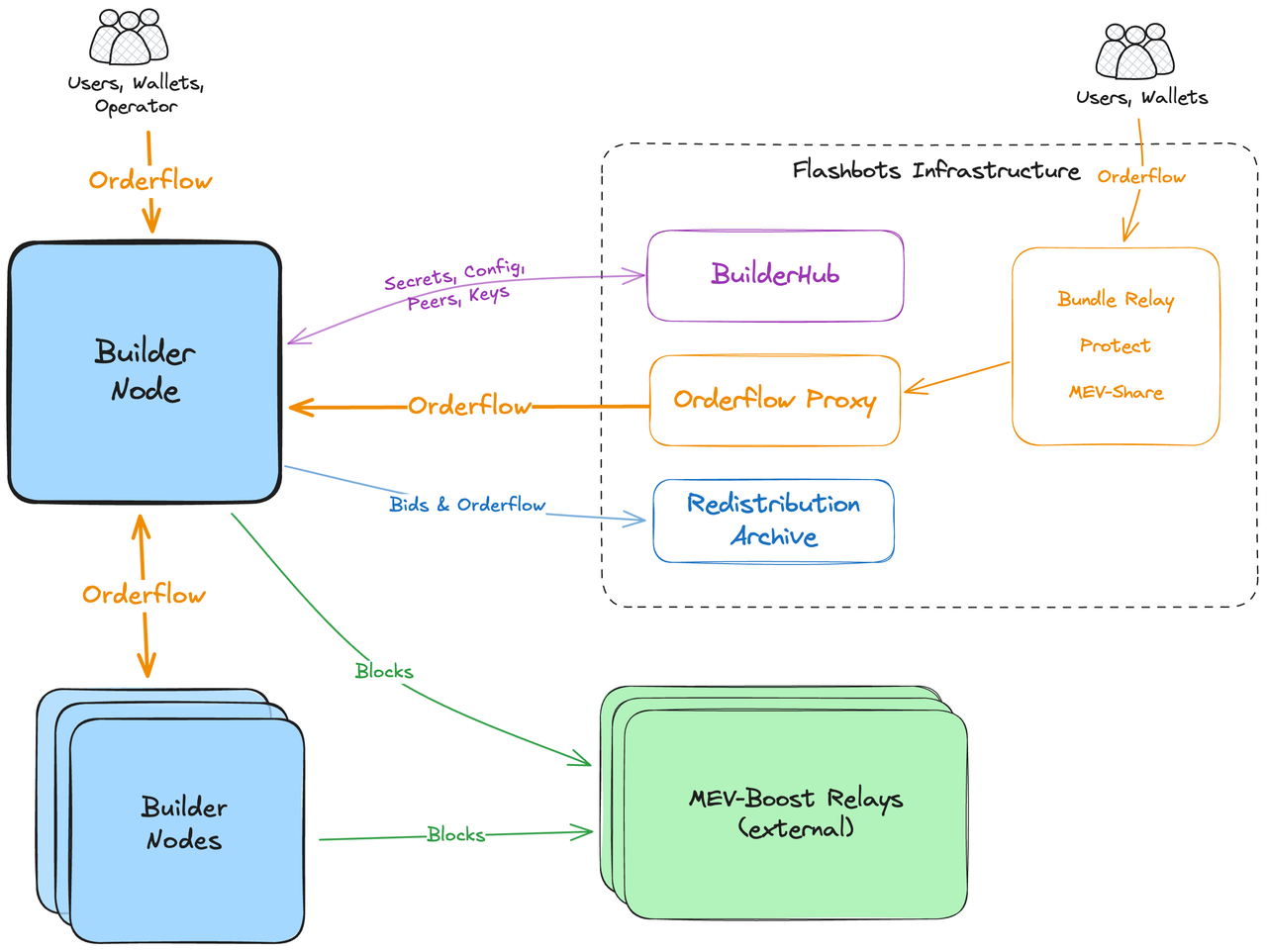

Main roles:

- Builder Node

- Node Operator

- Flashbots Infrastructure

- MEV-Boost Relay

- Orderflow Source

Orderflow Source includes wallets, applications, searchers, and end users.

Figure 1: BuilderNet high-level architecture

Flashbots Infrastructure

There are still two centralized components:

- BuilderHub:

- Handles node identity, key distribution, and peer discovery

- Nodes boot with TEE attestation and request configuration from BuilderHub

- BuilderHub verifies measurement + IP allowlist, then issues sensitive material such as coinbase keys and relay signing keys

- Redistribution Archive:

- Stores orderflow, bids, and block results

- Used for refund calculation and auditing

- At a 50% win rate, storage is roughly 30GB/day

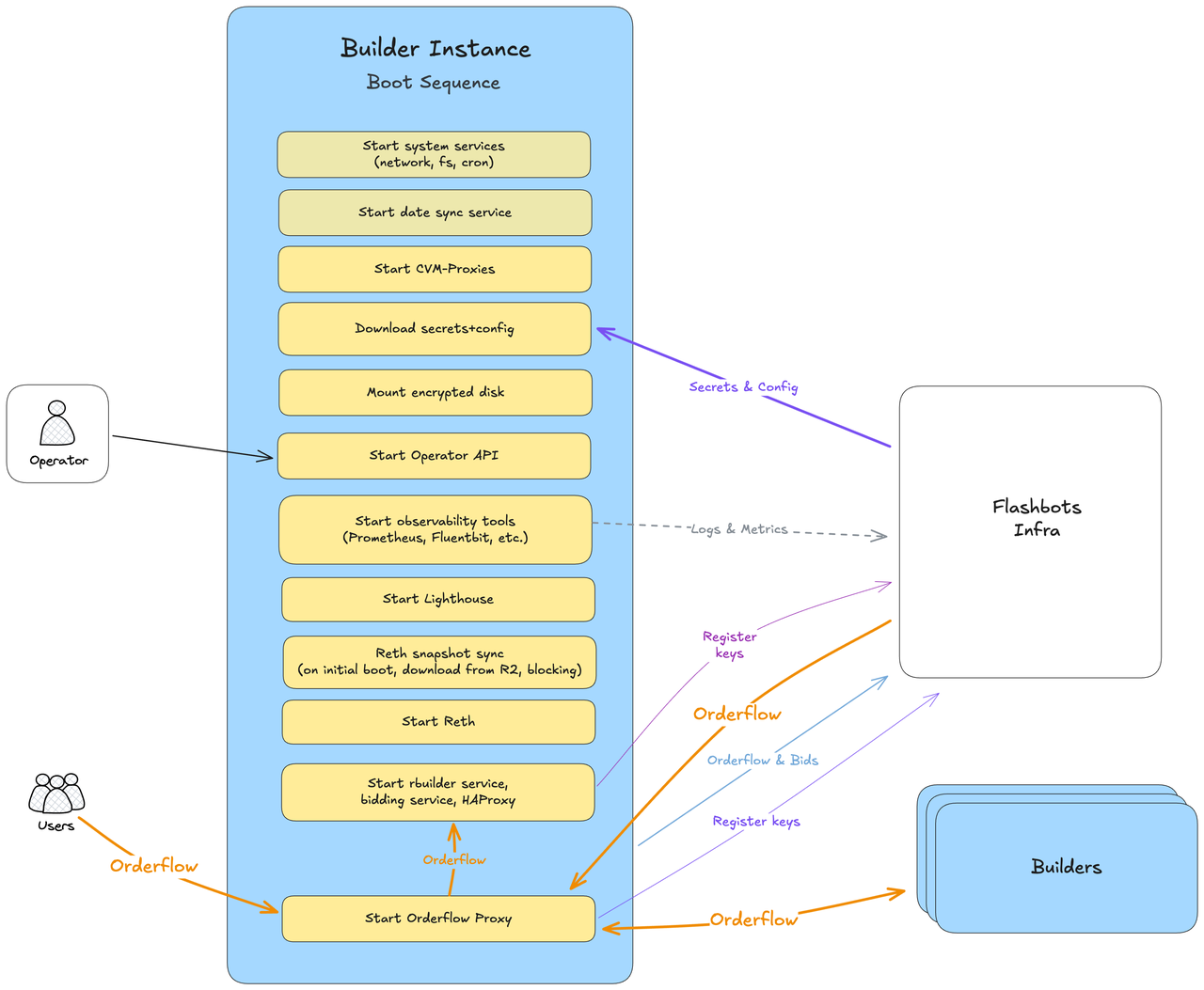

Node Boot Sequence

BuilderNet nodes are not Docker containers.

They run as full Linux TDX VM images built with Yocto (in .vhd format), on TDX-capable infrastructure such as Azure TDX Confidential VM or Intel 4th Gen Xeon Scalable+ hardware.

Flow:

- Start system services (network, filesystem, cron)

- Start time sync via NTP daemon (improved after v1.2)

- Start cvm-reverse-proxy for TEE attestation

- Pull secrets and config from BuilderHub

- Mount encrypted disk

- Start Operator API (system-api on port 3535)

- Start observability services (Prometheus/Fluentbit)

- Start Lighthouse (consensus client)

- Run Reth snapshot sync

- Start Reth (execution client)

- Start rbuilder, bidding service, and HAProxy

- Start orderflow-proxy and begin receiving orderflow

Figure 2: Builder node boot sequence

How to Become an Operator

The network is currently permissioned.

Flow:

- Submit application

- Flashbots review

- Allowlist approval

- Bring node online

Roadmap direction is permissionless, but that transition is not complete yet.

Orderflow Distribution

The key component is orderflow-proxy, running in two places:

- Flashbots infrastructure side (aggregation)

- Inside each TEE node (receive, broadcast, archive, forward)

Sources

- Flashbots Bundle Relay: searcher bundles

- Flashbots Protect: private user transactions

- MEV-Share: partially revealed transactions with hints

- Direct Submit: users, wallets, and searchers connect to any BuilderNet node

Responsibilities of orderflow-proxy

- Receive orderflow from Flashbots infrastructure

- Receive P2P-forwarded orderflow from other nodes

- Receive direct submissions to the local node

- Broadcast local orderflow to peers for a converged pool view

- Send a copy to Redistribution Archive for refund accounting

- Forward to local

rbuilder

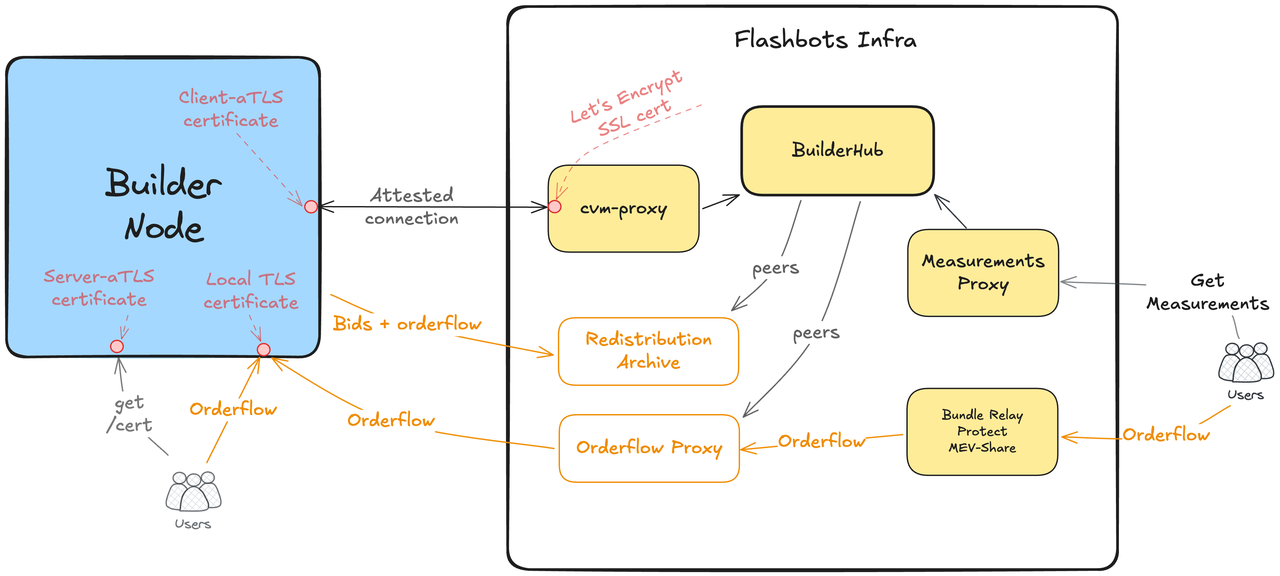

End-to-End Encryption

orderflow-proxy generates TLS certificates and ECDSA keys inside TEE and registers them with BuilderHub.

Node-to-node links are TLS encrypted, and peer certificates are matched against BuilderHub-registered public keys.

Users can also use aTLS to verify node identity before sending orderflow.

Figure 3: Trusted connectivity between node and infrastructure

Block Building Pipeline

The core engine is rbuilder (Rust, built on Reth).

Inputs

- Transactions and bundles forwarded by

orderflow-proxy MEV-Sharehints- Local Reth mempool

Processing Steps

- Simulation and validity checks (including gas constraints)

- Bundle merge + ordering for value maximization

- MEV extraction (backrun, arbitrage, etc.)

- Compliance filtering based on operator blocklist

- Gas optimization by transaction ordering

Packaging and Submission

Packaging phase:

- Apply

withdrawals - Run

post-blockcalls - Compute

state root hash - Package full block

Submission phase:

- Private

bidding servicecomputes bid price - Submit to multiple MEV-Boost relays

- Write

BuilderNet (operator_id)intoextra_datafor on-chain attribution

v1.3 highlights:

- Regional relay-only submission (about 50ms cross-region savings)

- Bundle cancellation support

- ~2x p99 end-to-end latency improvement

Refund Mechanism

Goals

- Give users, wallets, apps, and searchers a more transparent MEV path

- Reduce per-transaction net cost to land on chain

- Keep network operations sustainable

| Goal | Description |

|---|---|

| Transparency | Replace opaque off-chain orderflow deals |

| Permissionless | Anyone can receive refunds under public rules |

| Cost Minimization | Each transaction pays only the required competitive amount |

| Anti-Sybil | Identity constraints prevent refund gaming via split identities |

Refund Logic

- BuilderNet competes in MEV-Boost auctions

- If a winning block is bid below its true value, the gap becomes distributable remainder

- For landed transactions from

eth_sendBundle,mev_sendBundle, andeth_sendPrivateTransaction, BuilderNet estimates contribution by replay/simulation - Remainder is distributed proportionally to contribution

| Scenario | Eligible for Refund |

|---|---|

| Private submitted transaction/bundle | Yes |

| Public mempool transaction | No |

| Bundle containing only public mempool tx | No |

| Bundles from the same signer | Treated as non-competitive (merged) |

Note:

- This is different from the built-in refund field in

eth_sendBundle

eth_sendBundle refund fields:

refundPercent // Integer: 1-99 refundRecipient // String: refund recipient address

Flat Tax Rule (Core Formula)

| Symbol | Meaning |

|---|---|

| T | Set of all bundles |

| B(T) | Most profitable block constructed from T |

| v(T) | Value of B(T) |

| b_i(T) | Total payment from identity i's bundles if B(T) is realized |

| c | Payment sent by builder to proposer to win the block |

Marginal Contribution

mu_i(T) = min(b_i(T), v(T) - v(T \ i))

Marginal contribution is capped by payment, so net payment cannot become negative.

Refund Formula

phi_i(T,c) = ( mu_i(T) / sum_j mu_j(T) ) * min( v(B(T)) - c, sum_j mu_j(T) )

Interpretation:

v(B(T)) - cis distributable remainder- If remainder covers total marginal contribution, each participant can recover full marginal contribution

- Otherwise it is allocated pro-rata

Net Payment

p_i(T) = b_i(B(T)) - phi_i(T,c)

Net payment = gross payment - refund.

Identity Constraint (Anti-Sybil)

To prevent split-identity bundle strategies from extracting extra refunds, BuilderNet adds a joint marginal contribution constraint.

Joint Marginal Contribution

mu_I(T) = min( sum_{i in I} b_i(T), v(T) - v(T \ I) )

Optimization Problem

Actual refunds psi(T,c) are solved as:

min_{r in R_+^n} sum_i (r_i - phi_i(T,c))^2

s.t. sum_{i in I} r_i <= mu_I(T), for all I subseteq B(T)

sum_i r_i <= v(T) - c

The objective is to stay close to Flat Tax outputs while satisfying joint and global constraints.

Numerical Example

Given:

- v(T) = 10 ETH

- c = 7 ETH

- mu_A = 1.5 ETH

- mu_B = 1 ETH

Computation:

- Remainder = v(T) - c = 3 ETH

- sum(mu_j) = 1.5 + 1 = 2.5 ETH

- Distributable = min(3, 2.5) = 2.5 ETH

- Refunds:

- phi_A = (1.5 / 2.5) * 2.5 = 1.5 ETH

- phi_B = (1 / 2.5) * 2.5 = 1 ETH

| Parameter | Value |

|---|---|

| Block value v(T) | 10 ETH |

| Proposer payment c | 7 ETH |

| A payment b_A | 2 ETH |

| A marginal mu_A | 1.5 ETH |

| B payment b_B | 1 ETH |

| B marginal mu_B | 1 ETH |

| Searcher | Gross Payment | Marginal Contribution | Refund | Net Payment |

|---|---|---|---|---|

| A | 2 ETH | 1.5 ETH | 1.5 ETH | 0.5 ETH |

| B | 1 ETH | 1 ETH | 1 ETH | 0 ETH |

If a participant's marginal contribution equals payment and remainder is sufficient, net payment can approach zero.

Payout and Impact

Tracking dashboards:

- BuilderNet Dashboard

- Flashbots Protect Dashboard

- BuilderNet APIs (subject to available endpoints)

Refund destination example:

| Item | Value |

|---|---|

| Refund Address | 0x62A29205f7Ff00F4233d9779c210150787638E7f |

| ENS | refunds.buildernet.eth |

Expected effects:

- Validators: limited short-term impact, possible long-term value shift toward orderflow providers

- Operators: future rules are expected to account for operating costs

API Interfaces

Orderflow API

Endpoints

Rate limit is around 3 requests/IP/second (subject to change).

| Region | Endpoint | Orderflow Port | TEE Port |

|---|---|---|---|

| Global | rpc.buildernet.org | 443 | 7936 |

| US | direct-us.buildernet.org | 443 | 7936 |

| EU | direct-eu.buildernet.org | 443 | 7936 |

Supported Methods

eth_sendBundle: supports signed headers, refund params, bundle cancellationeth_sendRawTransaction: no refund support, usually retried across multiple blocks

TEE Verification

Use attested-get:

go install github.com/flashbots/cvm-reverse-proxy/cmd/attested-get attested-get \ --addr=https://rpc.buildernet.org:7936/cert \ --expected-measurements=https://measurements.buildernet.org \ --out-response=builder-cert.pem

This validates TEE measurement during TLS handshake and exports a certificate bound to the VM image.

Operator API

Each node exposes system-api on port 3535, typically behind HTTP Basic Auth + TLS.

# Restart rbuilder curl --insecure --user admin:secret \ https://ip:3535/api/v1/actions/rbuilder_restart # Upload blocklist curl --insecure --user admin:secret \ --data-binary "@blocklist.json" \ https://ip:3535/api/v1/file-upload/rbuilder_blocklist

Since blocklists are per-operator, a transaction filtered by one operator can still be included by another.

Service Components

rbuilder: block construction enginebidding service: private bidding logicorderflow-proxy: ingest, P2P broadcast, archival forwardingsystem-api: operator control planeHAProxy: traffic routing and high availability- Prometheus/Fluentbit: metrics and logs

| Repository | Description |

|---|---|

| github.com/flashbots/rbuilder | Block building software |

| github.com/sigp/lighthouse | CL client |

| github.com/paradigmxyz/reth | EL client |

| github.com/flashbots/system-api | Interface between operators and services in TDX instance |

| github.com/flashbots/cvm-reverse-proxy | Verifies TDX measurements via aTLS |

| github.com/flashbots/buildernet-orderflow-proxy | Receives and multiplexes orderflow |

Titan Builder vs BuilderNet

High-Level Comparison

- Titan: more centralized path, usually lower latency

- BuilderNet: multi-operator shared orderflow with explicit refund mechanics

| Dimension | Titan | BuilderNet |

|---|---|---|

| Market Share | ~46-51% | ~27-39% |

| Architecture | Centralized, closed-source | Decentralized, open-source (TEE) |

| Orderflow | Exclusive flow (for example Banana Gun) | Shared across all nodes |

| Operators | Single team | Flashbots + Beaverbuild + Nethermind |

Why Titan Still Has Higher Share

- Exclusive orderflow relationships with major wallets/bots

- Latency advantage from centralized architecture

- Neutrality narrative (

no searching) that attracts some bundle flow

Public analyses often note a significant fee share from exclusive flow channels.

| Region/Item | Titan | BuilderNet |

|---|---|---|

| Global | rpc.titanbuilder.xyz | rpc.buildernet.org |

| US | us.rpc.titanbuilder.xyz | direct-us.buildernet.org |

| EU | eu.rpc.titanbuilder.xyz | direct-eu.buildernet.org |

| Asia | ap.rpc.titanbuilder.xyz | - |

| Rate Limit | 50/sec | 3/sec |

Bundle Tracing

Titan exposes a bundle status query (titan_getBundleStats), while BuilderNet currently lacks full parity.

curl -X POST -d '{"method":"titan_getBundleStats","params":[{"bundleHash":"0x..."}],"jsonrpc":"2.0","id":1}' \

https://stats.titanbuilder.xyz

MEV-Boost and Relay

What is MEV-Boost

MEV-Boost is open-source middleware by Flashbots for PBS in Ethereum PoS. Validators can source higher-value blocks from a builder market instead of building entirely by themselves.

A common public metric is that most Ethereum blocks currently flow through MEV-Boost paths.

Roles

- Searcher: creates value-extracting bundles

- Builder: assembles candidate blocks and bids

- Relay: validates/escrows blocks and forwards highest bids

- Validator: blind-signs and broadcasts blocks

| Role | Description |

|---|---|

| Validator (Proposer) | Chooses highest bid block and signs it |

| Builder | Constructs orderflow-rich blocks and submits bids |

| Relay | Trusted intermediary that verifies blocks and aggregates bids |

| MEV-Boost | Validator-side sidecar that connects to multiple relays |

Simplified Workflow

- Validator registers with relay

- At slot time, validator requests highest bid block header (no full tx body)

- Validator blind-signs

- Relay validates signature and returns full block

- Validator broadcasts

Blind signing reduces validator ability to frontrun or replace block contents before commitment.

Relay Responsibilities

- Aggregate submissions from multiple builders

- Simulate and validate block correctness/payment constraints

- Hide full contents before signature

- Release and broadcast after signature

- Provide historical data APIs

| Component | Function |

|---|---|

| Proposer API | Validator registration, header fetch, signed block submit |

| Builder API | Accepts block submissions from builders |

| Data API | Queries historical block data |

Optimistic Relaying

Some relays use optimistic mode for lower latency:

- return block first, complete parts of validation asynchronously

- if invalid, builder bears the penalty

Market and Censorship

- Builders usually submit to multiple relays to maximize win rate

- Relay policy differs on sensitive flow (for example OFAC-related addresses)

- Validators can reduce single-relay censorship exposure via multi-relay configs and

min-bid

| Relay | Market Share | Operator | Censorship Policy |

|---|---|---|---|

| Ultrasound Money | ~30% | Community | Non-censoring |

| Titan Relay | ~23% | Titan Builder | Non-censoring |

| bloXroute Max Profit | ~18% | bloXroute | Non-censoring |

| bloXroute Regulated | ~14% | bloXroute | OFAC-compliant |

| Flashbots | ~6% | Flashbots | OFAC-compliant |

| Agnostic | ~5% | Independent | Non-censoring |

| Aestus | ~3% | Independent | Non-censoring |

| Type | Relays | Notes |

|---|---|---|

| Censoring | Flashbots, bloXroute Regulated | Follows OFAC |

| Non-censoring | Ultrasound, bloXroute Max Profit, Titan, Agnostic, Aestus | Neutral policy |

| Time | Landscape |

|---|---|

| 2022.9 (post-Merge) | Flashbots dominated at ~82% |

| 2023 | bloXroute and Ultrasound rose; Flashbots fell to ~25% |

| 2024 | Blocknative exited; top 4 controlled 95% |

| 2025 | Ultrasound + bloXroute + Titan led |

Relay Economics

Relays are critical PBS infrastructure but still lack durable direct monetization in many setups.

| Role | Revenue Source |

|---|---|

| Builder | Block building profit (MEV + priority fee spread) |

| Validator | Bid paid by builders |

| Searcher | MEV profit |

| Relay | No direct revenue |

| Proposal | Content | Status |

|---|---|---|

| PBS Guild | Community-funded pool to subsidize relay operations | Rejected |

| Fee Market | Each relay charges ~1%; validators choose relay connections | Rejected |

BuilderNet and Relays

Submission Flow

bidding servicecomputes bid- Block is signed with relay key

- Submission fan-outs to multiple MEV-Boost relays

extra_datamarksBuilderNet (operator_id)

| Aspect | Traditional Builder | BuilderNet |

|---|---|---|

| Operations | Single entity | Multi-operator TEE nodes |

| Orderflow | Potentially exclusive deals | Network-wide sharing |

| Transparency | Black-box | Open-source rbuilder |

| MEV Distribution | Internalized/private deals | Public refund rules |

| Relay Submission | Direct relay submission | Through bidding service |

v1.3 Optimizations

- regional relay routing only

- bundle cancellation support

- about 2x p99 end-to-end latency improvement

Notes

- Latency remains the strongest share driver in high-frequency environments

- BuilderNet is more explicit on flow sharing + refunds, but still depends on some centralized coordination

- Private bidding logic is a practical tradeoff, but it reduces external auditability

- Per-operator blocklists improve censorship resilience at network level while increasing behavior diversity

Future: Enshrined PBS (ePBS)

Current MEV-Boost is out-of-protocol PBS and still relay-trust-heavy. The ePBS direction is to move PBS logic into the base protocol, but it remains an active research/iteration track.

| Aspect | Current (MEV-Boost) | Future (ePBS) |

|---|---|---|

| Relay Trust Model | Requires relay trust | Protocol-guaranteed |

| Implementation Mode | Optional sidecar | Protocol-enforced |

| Block Validation | Relay-side | Protocol-layer |

| Censorship Resistance | Depends on multi-relay setup | Inclusion List and related mechanisms |

Next Part

Block Builder Deep Dive: BSC PBS (II)